Taiwan Semiconductor Manufacturing Co. has solid plans for the next few years, but the foundry’s manufacturing technology design cycles are getting longer. As a result, to address all of its clients’ needs, the company will have to keep offering half-nodes, enhanced, and specialized versions of its fabrication processes.

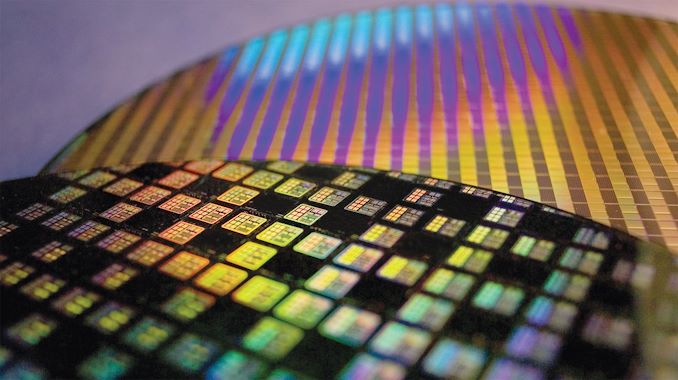

TSMC’s success in the last 20 years or so was largely conditioned by the company’s ability to offer a new manufacturing technology with PPA (power, performance, area) improvements every year and introduce a brand-new node every 18 – 24 months while maintaining predictably high yields. But as complexity of modern fabrication processes gets to unprecedented levels, it is getting much harder to keep the pace of innovation while also sustaining predictable yields and simple design principles.

With TSMC’s N3 node, the gap between N5 (5 nm-class) ramp up and N3 (3 nm-class) ramp up will increase to around 2.5 years, which may pose some challenges to the foundry’s key customer, Apple. The good news is that N3’s follow up, N3E, seems to be coming in ahead of schedule. Meanwhile, with N2, the cadence is set to stretch to about three years, which largely means a strategic shift in TSMC’s strategy of node development.

N3E: An Improved 3nm Node Pulled In (Almost)

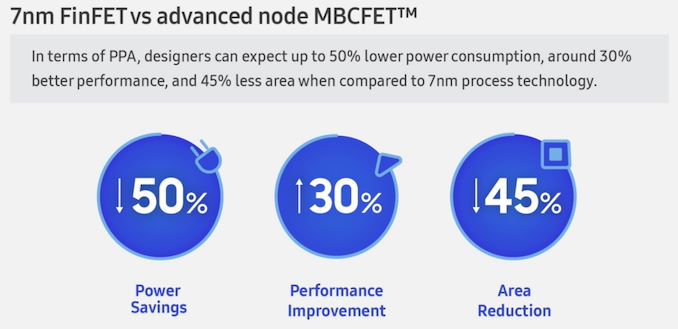

TSMC’s N3 is set to bring in full node improvements over N5, which includes 10% ~ 15% more performance, 25% ~ 30% power reduction, and an up to 1.7X higher transistor density for logic. To do so, it will use more than 14 extreme ultraviolet (EUV) lithography layers (N5 uses up to 14, and N3 is expected to use even more) and will introduce certain new design rules for deep ultraviolet lithography (DUV) layers.

Advertised PPA Improvements of New Process Technologies

Data announced during conference calls, events, press briefings and press releases |

| |

TSMC |

N7

vs

16FF+ |

N7

vs

N10 |

N7P

vs

N7 |

N7+

vs

N7 |

N5

vs

N7 |

N5P

vs

N5 |

N3

vs

N5 |

| Power |

-60% |

<-40% |

-10% |

-15% |

-30% |

-10% |

-25-30% |

| Performance |

+30% |

? |

+7% |

+10% |

+15% |

+5% |

+10-15% |

Logic Area

Reduction %

(Density) |

70% |

>37% |

– |

~17% |

0.55x

-45%

(1.8x) |

– |

0.58x

-42%

(1.7x) |

Volume

Manufacturing |

|

|

|

Q2 2019

|

Q2 2020 |

2021 |

H2 2022 |

TSMC is set to start ramping up production of chips using its N3 node in the second half of the year and will deliver the first commercial batch to a client (or clients) in early 2023, which is when it will receive the first N3 revenue.

While TSMC’s N3 process technology was designed both for high-performance computing (which is a term that TSMC uses to describe applications like CPUs, GPUs, FPGAs, ASICs, etc.) and smartphones in mind, there is evidence that the node has a rather narrow process window, which would make it hard for chip developers to hit desired specifications. This is a problem as it increases time-to-yield and ultimately lowers margins. In an apparent bid to tackle the issue, TSMC has developed N3E version of the technology that widens process window and provides improvements over N5.

“N3E will further extend our N3 family with enhanced performance, power, and yield,” said C. C. Wei, chief executive of TSMC.

Originally, TSMC planned to start high-volume manufacturing (HVM) using N3E about a year after N3 (i.e., in Q3 2023), but in the recent months a rumor emerged that TSMC was pulling in HVM of N3E by about a quarter due to better than expected test production runs. During its most recent conference call, TSMC confirmed that N3E’s progress was ahead of schedule and that it was considering pulling in mass production using this technology, but did not elaborate about exact plans.

“Our N3E result is quite good,” said the head of TSMC. “The progress is ahead of our schedule. And pull-in, yes, we are considering that. So far, I still did not have a very solid data to share with you that how many months we can pull in. But yes, it is in our plan.”

Keeping in mind that chip developers have their own schedules for their designs, it is unlikely that all of them will be able to take advantage of earlier N3E ramp since their chips have to pass all the pre-production iterations as well. Nonetheless, better-than-expected N3E progress is a good sign in general, especially considering the fact that TSMC’s N3 family will have to serve the industry for quite a long time.

N2: Expect First Chips in 2026

In fact, N3 and its evolutionary iterations will remain TSMC’s leading-edge offerings till late 2025 because the company’s N2 (2 nm-class) schedule looks quite conservative.

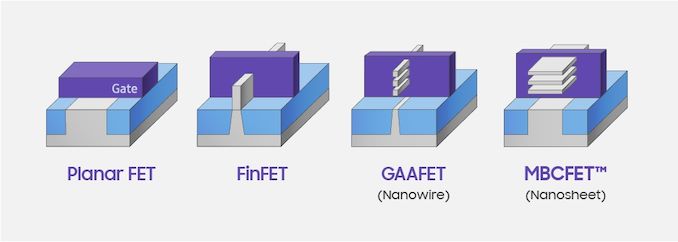

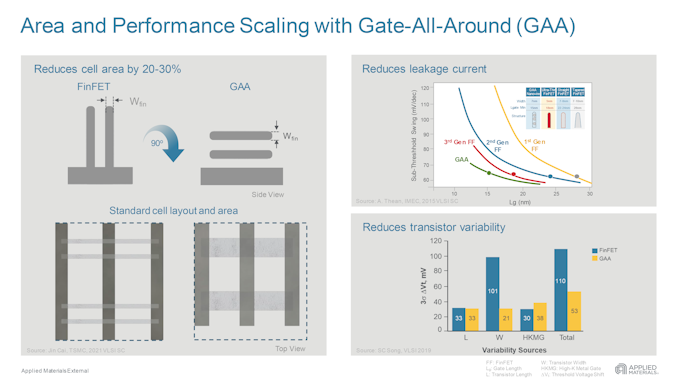

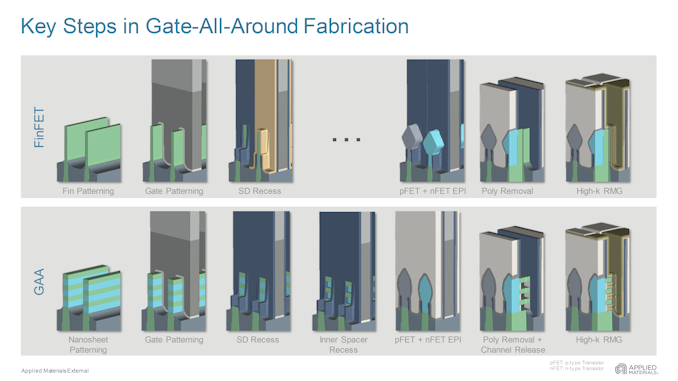

When TSMC first talked about its N2 in August 2020, it did not reveal many details about the technology (by now we know that it adopts gate-all-around [GAA] transistor structure) or its schedule, but indicated that it would build a brand-new fab near Baoshan, Hsinchu County, Taiwan, for this node (some sources call this new facility Fab 20). Taiwanese authorities approved the construction plan in mid-2021 and that plan included breaking ground in early 2022 (earlier this year TSMC’s board of directors indeed accepted capital appropriations for a new fab construction), so we believe that the shell is being built as we speak.

Shell construction usually takes a year or a little more, then equipment installation takes over a year as well, so we expect the first phase of Fab 20 to be ready by mid-2024 at the latest. TSMC expects to start risk production using its N2 technology in late 2024 and then initiate HVM towards the end of 2025, which means that the gap between the initial N3 ramp in Q3 2022 and initial N2 ramp in Q4 2025 will be about three years.

“Our progress so far today for the N2 is on track,” said Mr. Wei. “All I want to say is, yes, at the end of 2024, [N2] will enter the risk production. 2025, it will be in production, probably close to the second half or the – or the end of 2025. That is our schedule.”

Considering how long modern chip production cycles are, it is safe to say that the first N2 chips made by TSMC will arrive in consumer devices no sooner than early 2026.

| TSMC’s New Node Introduction in Recent Years |

| |

N7 |

N7P |

N5 |

N5P |

N3 |

N3E |

N2 |

| Transistor Type |

FinFET |

FinFET |

FinFET |

FinFET |

FinFET |

FinFET |

GAA FET |

| Risc Production |

? |

? |

? |

? |

2021 |

2022 |

Late 2024 |

Volume

Manufacturing |

Q2 2018

|

Q2 2019 |

Q2 2020

|

Q2 2021 |

Q3 2022 |

Q2/Q3 2023 |

Late 2025 |

But perhaps TSMC’s public disclosures about N2 and Fab 20 are too conservative. Analysts from China Renaissance Securities seem to be more optimistic about Fab 20 readiness than TSMC is, which may be an indicator that the foundry could pull-in N2 HVM by a quarter or even two if the fabrication process meets its performance, power, and yield goals.

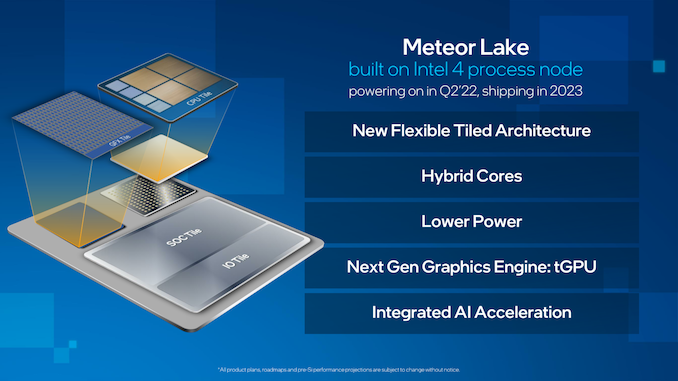

“We also see more clarity around TSMC’s N2 expansion schedule in Fab 20 (Hsinchu),” Sze Ho Ng, an analyst with China Renaissance Securities, wrote in a report for clients. “Tool move-in is expected to start by end-2022, based on company plans, ahead of risk production in late 2024E with Intel (client PC Lunar Lake’s graphic ’tiles’, while the CPU ’tiles’ are fabbed using Intel’s 18A) and Apple being the anchor customers for dedicated capacity support.”

Meanwhile, pulling in a node from Q4 2025 to Q3 2025 when alpha customers already set their plans for 2025 may not make a lot of sense, but we will certainly see how things work out with N2.

More N3 Iterations

This year, TSMC’s customers that need a leading-edge fabrication process will use the company’s N4 technology, which belongs to the N5 family (along with N5, N5P, N4P, and N4X). Essentially, this means that an N5 node will remain TSMC’s most advanced offering for three consecutive years.

N3 nodes will also have to serve TSMC’s clients for another three years (2023, 2024, 2025), so we are going to see several iterations of this process. So far, TSMC has formally confirmed N3E and N3X (which is another performance-oriented manufacturing technology akin to N4X aimed primarily at CPUs and datacenter ASICs), but I would expect more N3-derived nodes to come to address mainstream SoCs in 2024 ~ 2025.

Keeping in mind that TSMC’s FinFET-based N3 will have to stay competitive against GAA-based Samsung’s 3GAP and 2GAE/2GAP in 2023 ~ 2025 and Intel’s 20A (RibbonFET + PowerVia) in 2024 and 18A (High-NA EUV) in 2025, TSMC’s engineers will have to be quite creative with their N3 enhancements.

On the foundry side of things, TSMC will remain ahead of its rivals for quite a while since Intel is not expected to invest significantly in its IFS-dedicated capacity before 2025 (so its 20A and 18A capacities for IFS customers will likely be limited), whereas Samsung Foundry is traditionally behind TSMC when it comes leading-edge capacity and prefers to prioritize its parent company and strategic clients (e.g., Qualcomm). But formal process technology leadership is what TSMC’s engineers will have to maintain with N3 and it will be uneasy to do considering how aggressive Intel and Samsung are.

Changes Are Coming

Evidently, TSMC’s brand-new process development and ramp up cadence has increased to two-and-a-half years with N3 and will increase to three years with N2, which may be considered as a major slowdown by its key customers. Meanwhile, potential pull-in of N3E is a good sign which shows that the company can make its intra-node advancements fairly quickly. Hence, the main question is how significant will TSMC’s intra-node advancements be going forward. This is a question that only time will answer.

In the meantime, it looks like with TSMC’s three-year new node development cycle, future intra-node advancements will be significantly more important for the company and its clients than they are today.

![]()

![]()

Source: AnandTech – TSMC Roadmap Update: N3E in 2024, N2 in 2026, Major Changes Incoming